Dylan B. Minor PhD, MSBA, CFP®, ChFC, CLU

Chief Strategist and CIO

These are forceful and huge steps. The Fed is doing whatever it takes.

Mark Sobel, former U.S. Treasury official

In this note, I provide an update on financial markets and the economy, an overview of some of the important features of the new Coronavirus Aid, Relief, and Economic Security Act (CARES Act) signed into law over the weekend, and some suggestions of what to do now.

When we first started regularly using the term novel coronavirus circa early February of this year, my baseline case was for the virus to have a modest impact on the US economy, mostly through supply disruptions. This view was partly informed by the history of past pandemics. For example, the so-called Spanish Influenza, often referred to as the worst pandemic in modern times, infected up to 30% of the world’s population, of which estimates report 6-10% perished. This would amount to about 150 million deaths based on the world’s current population. In the US, many cities tried various forms of social distancing, quarantines, and isolation. Only one recorded city closed its businesses, though to be fair Zoom was not an option in 1918. Few cities engaged in restrictions for more than 6 weeks.1 However, some reacted much more swiftly than others in making these nonpharmaceutical interventions (NPIs). In the end, an estimated 550,000 to 675,000 Americans still perished. For our current US population, that would be around 2 million deaths today. Despite these staggering losses of life, it is estimated economies only declined an estimated 6% in most countries, as a result of the Spanish Flu. For the US, the estimate was a smaller reduction of 1.5 to 2% of GDP, as less than .6% of the US population perished from the Spanish Flu.2 The conclusion of the Spanish Flu (there were three waves) was greeted by the roaring 20’s.

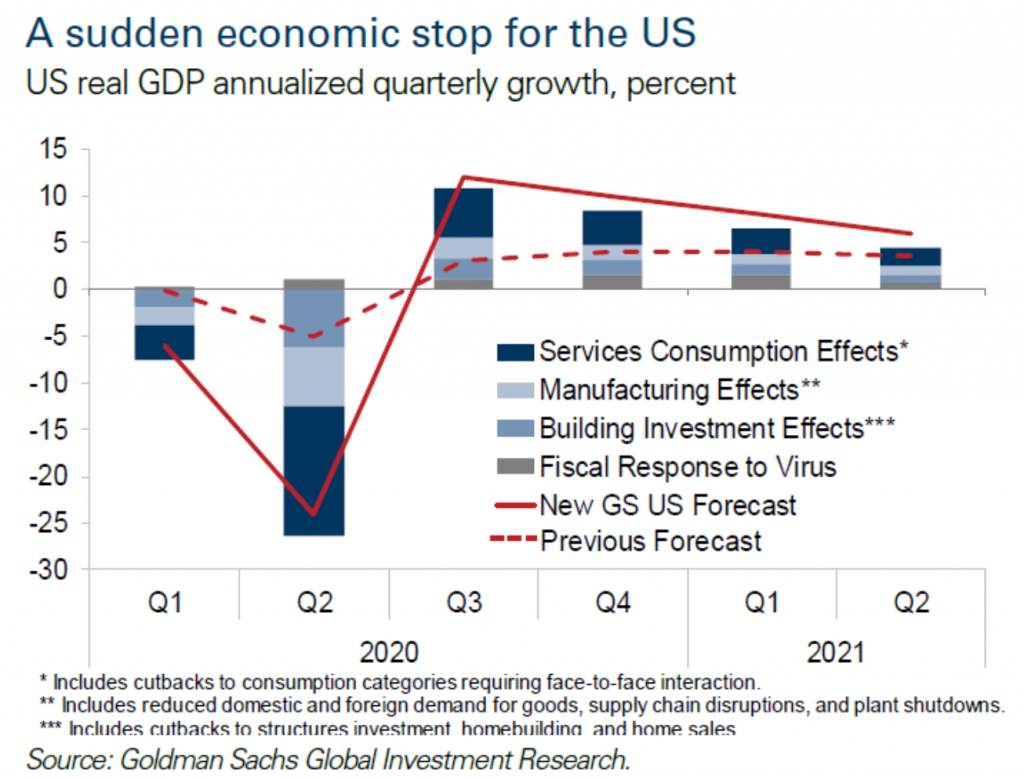

This time, with COVID-19 (i.e., coronavirus disease 2019), the global economy was swiftly shutdown. In the US, almost 70% of our economy is based on consumers buying goods and services. When people are largely stuck at home, stores are closed, and purchases on Amazon are less accessible (to make room for more consumer staples sales), the economy should fall dramatically. And apparently it is. Estimates are suggesting that the US economy will shrink 6-8% in Q2, for an annualized fall of over 30% (see below chart from Goldman Sachs research). We have had record unemployment claims, and more are to follow. The global recession has begun. Nonetheless, current estimates show US economic recovery through year-end 2020.

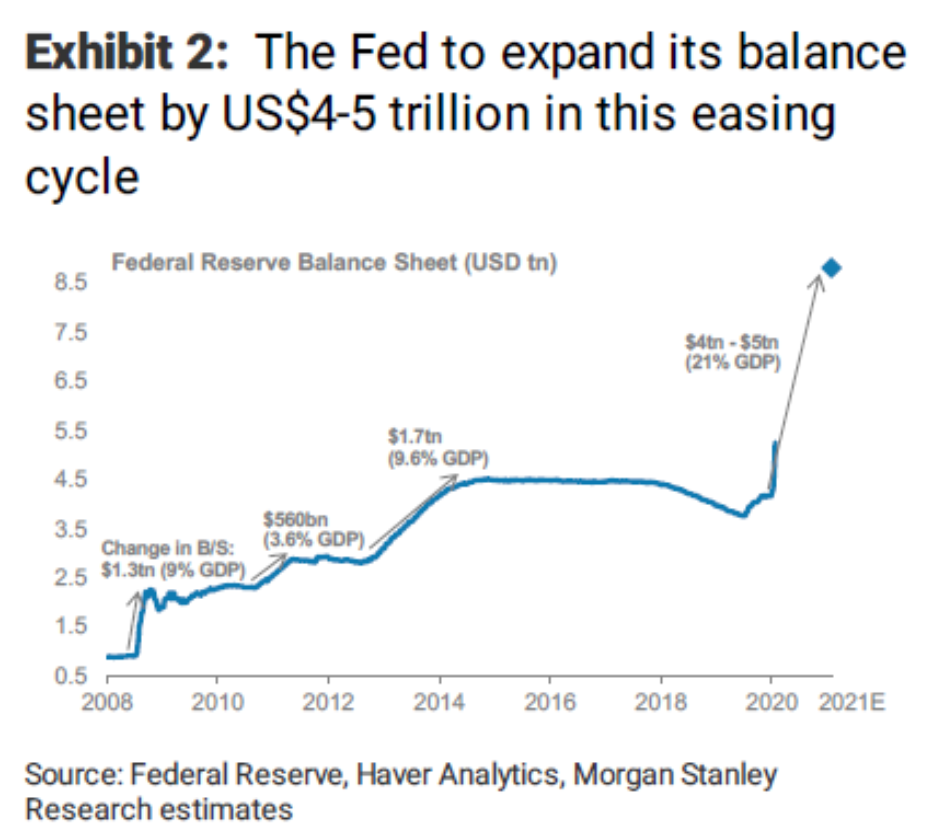

In response to this deep global recession, world governments have provided aggressive fiscal and monetary responses. In the US, the Federal Reserve has promised essentially unlimited support. The current plan is to almost double its current balance sheet, as shown below.

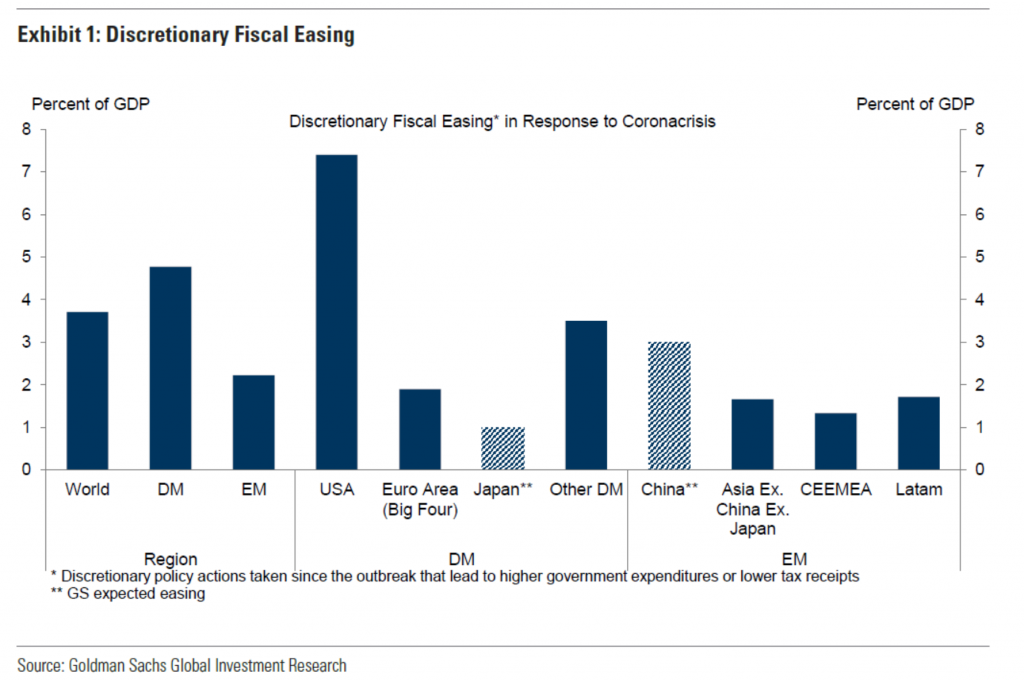

In terms of fiscal response, over the weekend the CARES Act was passed, representing the largest fiscal stimulus in the history of the US with over $2 trillion in total aid. Some of its provisions should help each of you, as I detail below. This record-breaking US fiscal stimulus is over two times the average response of the world so far, as measured by percent of GDP.

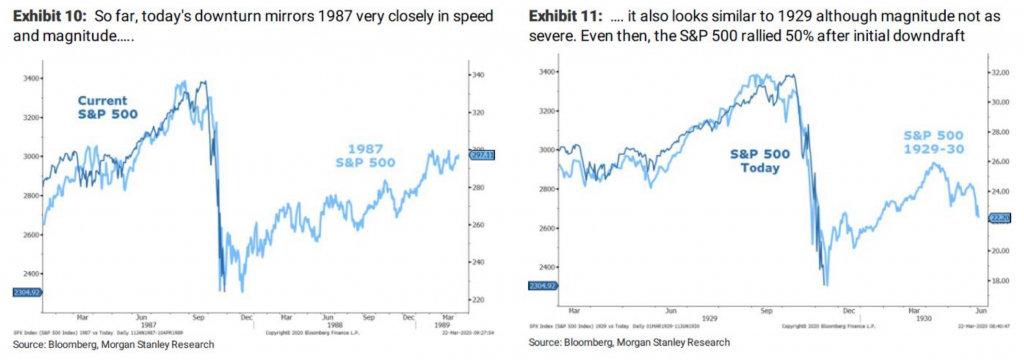

On whole, the stimulus should prove helpful. However, it should be noted that we will likely experience some continued significant ups and downs in the equity markets before we begin to see the stimulus work and policymakers see proof of COVID-19 caseloads stabilizing in the US, which could happen as soon as a few weeks from now, based on some empirical models (of course, these estimates are always subject to upward or downward revisions as a function of testing capabilities, any changes in NPIs, and potential therapeutic breakthroughs). The current stock market fall looks similar to some past falls, which all tend to exhibit a bouncy recovery, as shown below:

Of course, the present is never a perfect picture of the past. In this spirit, the current fiscal stimulus was passed much more swiftly than the stimulus during the 2008 financial crisis, which hopefully is a harbinger for a swifter recovery. In addition, as I pen this, Nancy Pelosi is already discussing the next stimulus bill.

So how might the $2 trillion fiscal stimulus help you directly? Here are several possible ways:

- You will receive $1,200 of cash per tax filer (assuming single or joint AGI below 75,000 or 150,000, respectively—after these income levels these payments are phased out). There is a potential additional $500 per child. The timing is “as soon as possible” but no later than December 31st, 2020. My estimate is within 1 month.

- You can potentially withdrawal up to $100,000 from your retirement account or IRA for no penalty and either pay it back (akin to a rollover) or spread the taxes over 3 years.

- You are no longer required to take a minimum distribution from your retirement account during 2020

- If you have lost your job, your total unemployment benefit will be potentially more than doubled and the maximum benefit period increased 50%

- If you have a small business, you will likely be eligible for effectively a grant to help cover payroll. Additional deferrals and subsidies are potentially available, as well as a disaster loan.

In addition to these benefits, the IRS and CA have deferred tax payment deadlines at least until 7/15/2020, further helping people shore up cash positions.

Finally, benefits from current depressed asset prices are at least four-fold:

- It is now potentially more cost effective to convert low-basis concentrated positions to diversified ones

- Roth conversions are more attractive, both from depressed current prices and potentially lower 2020 taxable income

- Tax harvesting is available

- Rebalance opportunities abound

We continue to explore these strategies, where appropriate, for each of you.

So what can you do in the meantime? I have a worked up a homework list for you:

- Learn a new skill or art form. There is a plethora of new online offerings, as well as good-old fashioned books from which to learn.

- Call a friend or family member you’ve been too busy to call before the crisis.

- Read a great book (always a great idea!).

- Learn a new recipe (and gratefully eat it!).

- Discover a new workout routine.

So get to your homework, and of course, if there is anything we can help with do not hesitate to call or write to us. Meanwhile, we’ll continue to be busy with our homework: helping caretake your financial well-being as cleverly and consistently as we can…

- Hatchett, R. J., Mecher, C. E., & Lipsitch, M. (2007). Public health interventions and epidemic intensity during the 1918 influenza pandemic. Proceedings of the National Academy of Sciences, 104(18), 7582-7587.

- Barro, R. J., Ursua, J. F., & Weng, J. (2020). The Coronavirus and the Great Influenza Pandemic: Lessons from the “Spanish Flu” for the Coronavirus’s Potential Effects on Mortality and Economic Activity (No. w26866). National Bureau of Economic Research.

Omega Financial Group LLC is a Registered Investment Adviser. This commentary is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Omega Financial Group LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible los of principal capital. No advice may be rendered by Omega Financial Group LLC unless a client service agreement is in place.