Dylan B. Minor PhD, MS, CFP®, ChFC, CLU

Chief Strategist and CIO

Whereas US financial markets dominated much of the world this past year, international ones—both developed and emerging—have begun to prove more promising than the US. Indeed, while the SP500 garnered a healthy return of over 5% through 4/21 (year-to-date), developed International markets, as proxied by the MSCI EAFE index, approached a 7% return and emerging markets, as proxied by the MSCI EM, approached almost 12%, year-to-date. All the while, the US dollar is close to where it was at the beginning of the year against many currencies, which means foreign investors enjoyed returns similar to dollar-based investors.

On the other side of the risk spectrum, bonds, in contrast to (most) everyone’s expectations, and despite the FED raising the Fed Funds Target to 1% and perhaps doing so several more times later this year, the 10-year US Government yield has fallen from 2.43% to 2.24%. The net result has been that most bond markets have enjoyed overall returns this year of around 1-3%, depending on the region, credit quality and maturity.

In terms of equity style factors, large-cap and growth styles have on whole far outpaced smaller and value-biased equities, not just in the US, but around the world. In fact, small-cap value is actually down some .7% year-to-date. This year’s factor returns were largely a reversal of what happened after President Trump’s win this past year. At that time, investors poured money into smaller capitalization stocks and shunned domestic companies with more international exposure, as well as international stocks in general, reflecting the view that increased trade protection would come from a Trump presidency. But it seems Mr. Trump has recently turned his ship a bit, reversing at least three campaign-trail promises, which included commitments to:

- champion trade protection (he said he might soften trade rules with China for help on North Korea)

- avoid a fight with ISIS (he sent dozens of Tomahawk missiles to a Syrian airfield)

- see rates rise (he says he actually likes Yellen and her lower interest rates).

Thus, financial markets have again adjusted based on this new worldview.

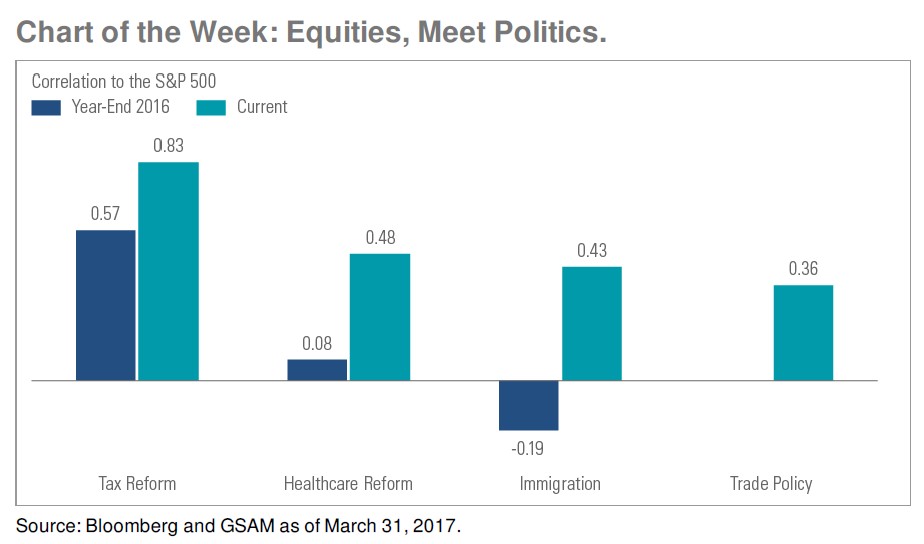

I teach my MBA students that political factors are often an important determinate of the price of stocks. Indeed, sometimes these factors can be even more important than fundamental financial factors. Most recently, we can see the potential importance of politics through a fascinating chart produced by Goldman Sachs:

As can be seen, more than ever, market returns are strongly correlated to policy shifts: a higher correlation means a stronger relationship. This chart also suggests that top-of-mind for investors is tax reform.

But what does this all mean for you? It first means that as the political ships turn, so too will market values. And since this is also a year with some significant new policies being passed (or failing to be passed), expect increased volatility throughout the year, as these policy directions become settled.

But more important than this is in the longer-term, it should not frankly matter that much for financial markets. Do you remember the dramatic government shutdown in 2013? My daughter sure does. She was very upset we couldn’t see some park buildings during our family vacation. During this time, I recall many investors thinking it was a good time to get out of the US stock market. What has happened since then? Well, the US stock market, as measured by the SP500 is up over 40% since then. And now we face another potential government shutdown this very week! Of course, this doesn’t mean that this time it will be the same as it was last time (in fact, I’d say there is a much lower probability of shutdown this week and thus a higher probability of a non-event).

In the end, we don’t know where the ship may turn to next, but we do know it will probably turn. In my view, one key here is to be strategically diversified for different States of the World®, so you’re not excessively dependent on any one particular turning of the ship. And yet another key is to have some good life distractions to shift your market focus from daily to weekly to monthly to quarterly to even less frequently. One of the reasons we hope that you hired us is to allow us to do your daily worrying for you (at least over financial matters). To this end, we thank you for your faith and trust in us and hope you have a quarter filled with more interesting things than politics…

This commentary reflects the personal opinions, viewpoints and analyses of the Omega Financial Group, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by Omega Financial Group, LLC or performance returns of any Omega Financial Group, LLC Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Omega Financial Group, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.