Dylan B. Minor PhD, MS, CFP®, ChFC, CLU

Chief Strategist and CIO

Many clients have begun to ask me: isn’t the stock market overvalued? On one level, in a free market, everything is currently valued at what it should be. However, that assumes a world where everyone is perfectly rational. I sometimes forget that I’m not always rational (which is not rational), but I can always look to my neighbor to be reminded that we are not always rational creatures.

So the question of value is a good one. Overvalued assets can create bubbles, and bubbles can cause bad things to happen. In recent history, the housing market bubble proved disastrous. So too many moons ago, the Dutch experienced a bubble in Tulip prices that ultimately ended in collapse in the 17th century. At the peak of the bubble, some Tulip bulbs were being sold at ten times the average annual craftsmen’s wages. And there have been many irrational pricing events in between these two. One of my favorite is the Pet Rock. Here, people were buying a simple rock, a short instruction manual, and a cardboard box for $20 in 2017 dollars.[1] Although the sales eventually dried up (after people came to their senses, in my view), the person who thought up the idea became a millionaire.

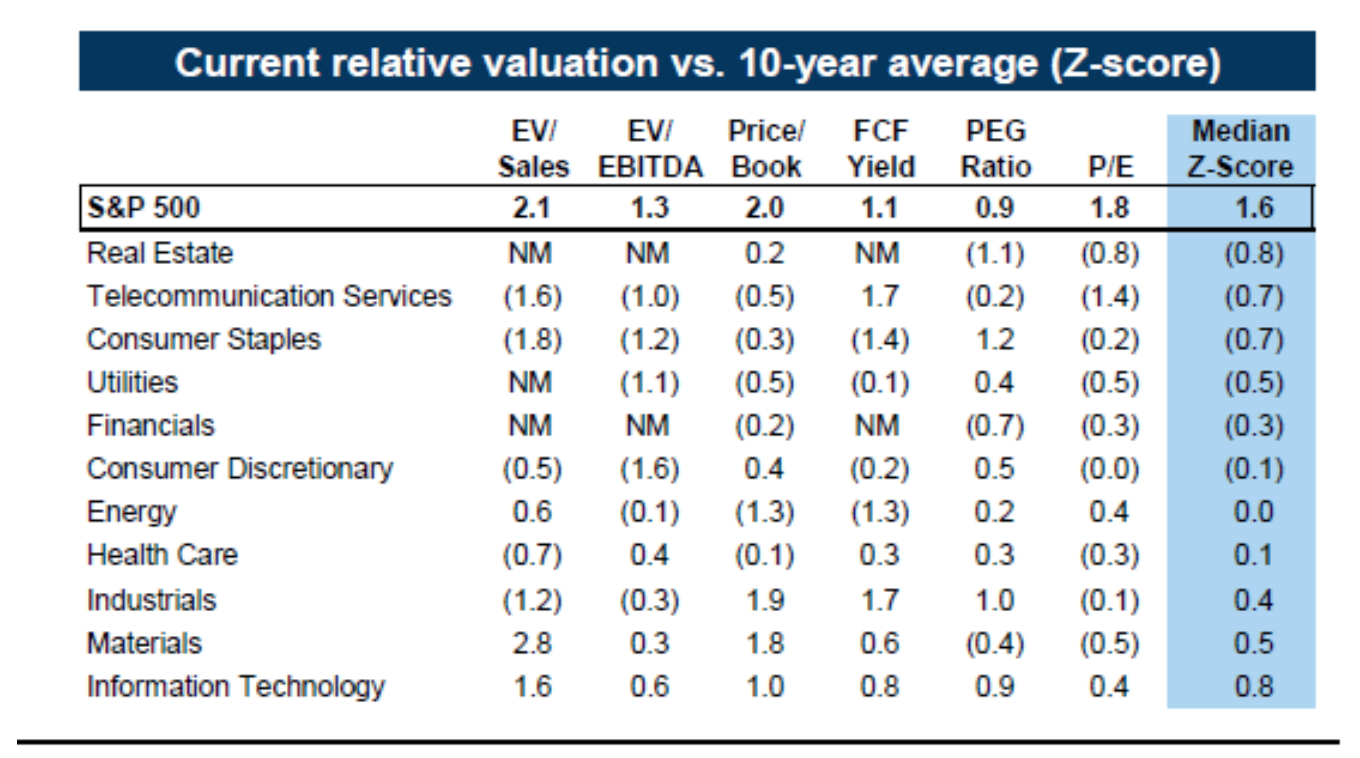

So how do we determine if the stock market is currently forming an asset bubble? We can turn to some historical figures here. The following table from Goldman Sachs Research reports the current value of the SP500 based on different commonly used metrics as of 10/20/2017.

Source: Goldman Sachs Institutional Research

A score of 2.0 (or higher) means that the given measure shows that the S&P500 is overvalued compared to historical norms, and that this overvaluation is statistically significant. For any measure, the greater the score, the greater the valuation compared to the 10-year historical averages. Two of six of the reported measures identify that the market (i.e., as measured by the S&P500) is currently overvalued on a statistically significant basis. The average (median) score is 1.6. In sum, this means that the US stock market’s current valuation is evaluated (though it does not mean that it is universally overvalued, and certainly doesn’t suggest an asset bubble). It is also interesting to note that while the overall market valuation is elevated, some of the sectors (e.g., Real Estate and Telecommunications) are actually undervalued, by most measures.

So what are the consequences that the US stock market is currently more highly valued? Doesn’t this mean that a bear market is more imminent and if there is a drawdown, it will be more severe? Remarkably, the answer is no and no. It is notoriously difficult to time bear markets. In fact, in all of my research I have not found a system of signals that can successfully predict bear markets (beyond what one could do by chance). So the bad news is we really cannot predict bear markets, even when we know market valuations are elevated. However, the good news is that we do not need to. Indeed, when US stocks carry an average valuation, they tend to fall an average of 11% the following year, at their worst point. When the market is “highly” valued, it tends to fall a similar 12% the following year, on average.

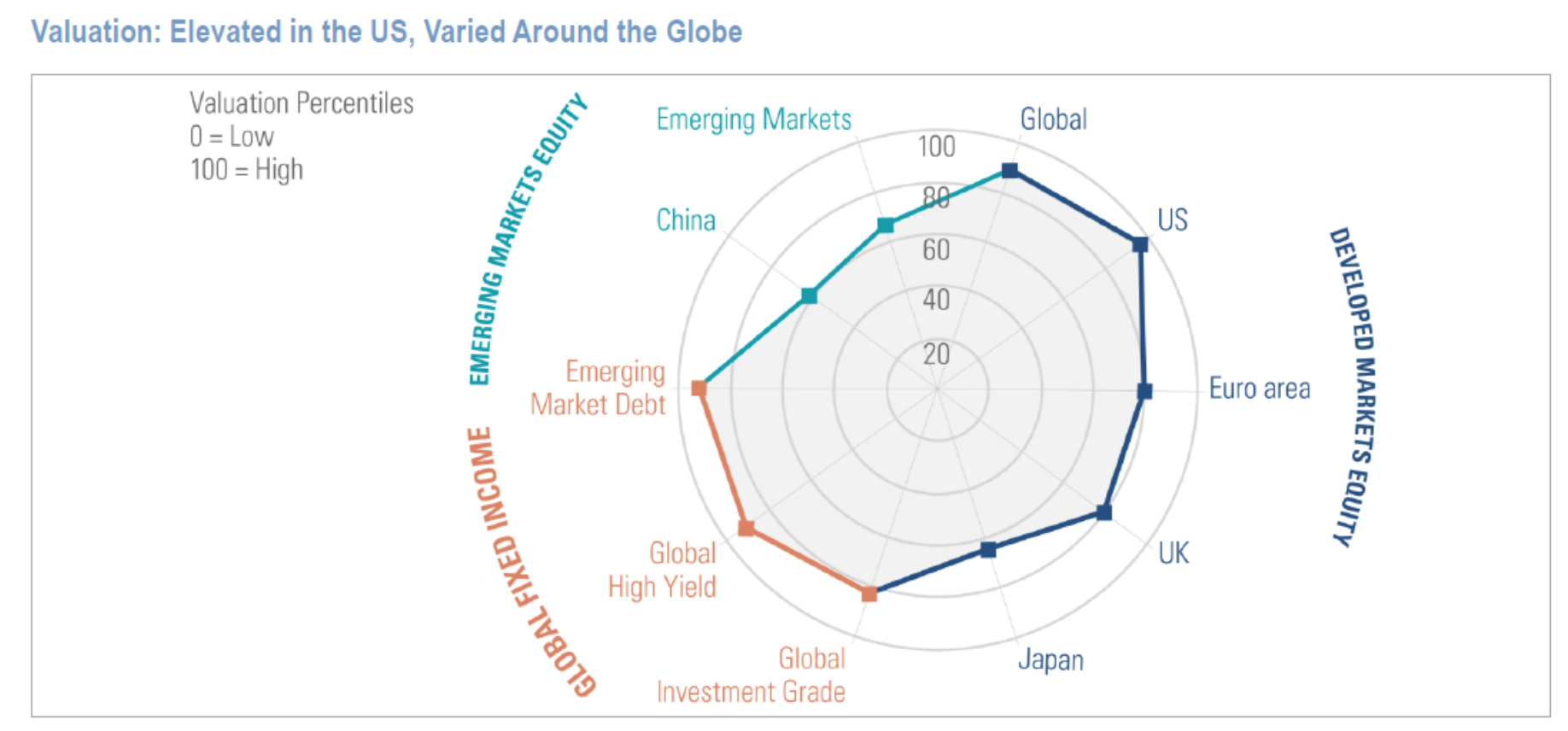

Finally, it might be helpful to have a global perspective on valuations. The following chart from Goldman shows relative valuations across a multitude of asset classes. The closer a box-dot is to 100 for a given asset, the greater the valuation. As one might expect, valuations vary quite a bit across assets classes, and not all are overvalued.

Source: Goldman Sachs Institutional Research

Almost for sure, someday, US Stocks will materially fall in value, returning to lower valuations. This may happen next month or in many, many years. But when it does happen an important part of our strategy is our States of the World® wealth management approach, where we have allocated to other assets classes that can still survive if not thrive if large US stocks fall. At that time, we will likely be rebalancing from some of these alternative assets back into US Stocks, to maintain our risk targets for your own unique situation. So, in short, worrying about valuations and a possible bear market is a chasing after the wind. Instead, we suggest that you enjoy the holidays!

This commentary reflects the personal opinions, viewpoints and analyses of the Omega Financial Group, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by Omega Financial Group, LLC or performance returns of any Omega Financial Group, LLC Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Omega Financial Group, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

[1] I’ll grant that the instruction guide that came with the rock was clever and entertaining, but I’m not convinced that it made it worth $20. But perhaps the rock was more exciting than I realize.